Best Places to Buy Land in Nigeria Before Prices Jump in 2026

December 12, 2025

admin

If you’ve ever watched a neighbour sell land bought years earlier for a tidy profit, you’ve seen one of Nigeria’s most enduring wealth-building strategies in action. The truth is simple: land values in Nigeria have been rising steadily as infrastructure expands, populations grow, and urban centres spill outward. Buying land now, before prices jump further in 2026, isn’t about speculation, it’s about positioning yourself where growth is real and where demand is emerging.

Understanding where to buy means balancing current affordability with future growth prospects. Let’s explore the hotspots that make sense right now, especially if you’re serious about gaining appreciation and creating long-term wealth.

Strategic Lagos Corridors

Lagos remains Nigeria’s economic heart, and land in the right corridors is appreciating faster than almost anywhere else. Areas like Ibeju-Lekki continue to attract major infrastructure developments—the deep sea port, industrial parks, and transportation upgrades, making land here a strategic buy before prices escalate significantly next year. Studies show that land in these developing zones has already seen rapid growth and is expected to keep rising as projects reach completion.

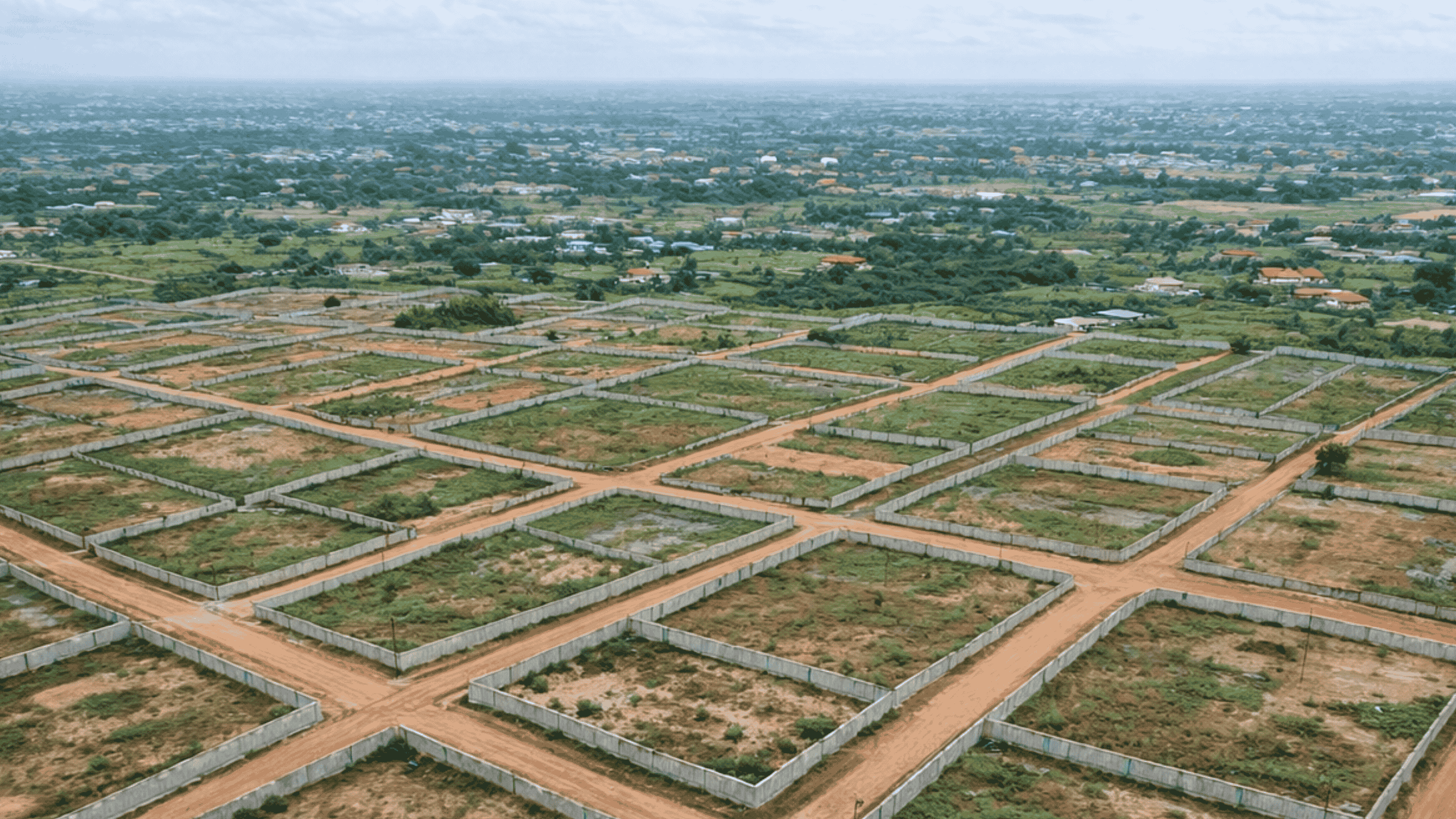

Within Lagos itself, emerging estates such as Godson Homes Phase 2 in Ketu-Epe are capturing investor attention with real growth potential. Positioned in what many local developers call the “new Lagos,” Godson Homes Phase 2 offers dry, well-fenced land with good road access and plans for future infrastructure. Prices start as low as ₦3,000,000 for 250 sqm, and payment plans make it accessible for many buyers. Proximity to amenities like educational institutions, Lagos-Ibadan expressway access and leisure hubs enhances future demand.

Even if you don’t build immediately, land here is likely to appreciate as more developments cluster around this axis.

Ogun State: The High-Growth Frontier

Just outside Lagos, Ogun State has quietly become one of the most compelling investment zones in Nigeria. Its proximity to Lagos, expanding expressways, and industrial hubs means people and businesses are increasingly spilling across the border. Within this context, Prymeview Gardens in Obafemi-Owode stands out as a high-potential location to secure land before prices escalate. This estate offers plots from around ₦1,750,000 for 250 sqm up to larger sizes for family homes or commercial use, with registered surveys and buy-and-build flexibility.

What makes Obafemi-Owode exciting isn’t just affordability; it’s the trajectory. Infrastructure plans connecting this region to Lagos and other commercial centres hint at stronger demand over the next 18–24 months. Buying here today means acquiring land that many newcomers to the market will be chasing tomorrow.

Port Harcourt & Eastern Growth Zones

Rivers State’s Godson Rehoboth Estate in Elele/Abara presents another attractive option with strong fundamentals. Priced competitively, plots around ₦1.5 million to ₦2 million for decent sizes, this location benefits from proximity to Port Harcourt’s commercial and institutional nodes. With universities, airports, and a growing urban population nearby, land here offers both residential and investment appeal.

Eastern Nigeria’s urban population continues to grow, creating consistent demand for land as families seek space to build homes and investors seek rental or resale opportunities. Buying land in these markets now positions you ahead of the curve as next-year interest rises.

Why Timing Matters in 2026

Market data and local trends point to accelerated land value increases in Nigeria’s growth corridors. This isn’t just hype, urban migration and economic activity concentrate in specific axes year after year. Investment hotspots are not random; they follow infrastructure, employment hubs, and transportation networks. Early buyers in these zones often enjoy the best appreciation because they secure land before mass adoption sends prices up.

But remember: price jumps are real only when development fundamentals exist. Cheap land alone isn’t a reason to buy; what matters is growth potential backed by real infrastructure, access, and legal clarity. That’s why dealing with transparent, experienced developers and verified estates is crucial.

Practical Advice Before You Buy

First, always inspect the site yourself and verify documents like survey plans and titles. Doing this protects your investment and ensures you are buying real, developable land. Legitimate firms like Pryme Point Real Estate provide site visits, verified surveys, and clear documentation to help buyers avoid common pitfalls in the Nigerian market.

Second, consider your purpose. Are you buying for future building? For resale? For rental income or agriculture? Your intended use will help determine the best location and plot size. Finally, never ignore due diligence, even affordable land can become a problem without clear titles and government-approved layouts.

Conclusion

As 2026 approaches, the smartest land buyers are those who act before prices rise further. Lagos’s developing corridors, strategic Ogun zones, and emerging Eastern hubs offer real potential for value appreciation. By focusing on growth fundamentals and verified opportunities, especially from reputable estates like Godson Homes Phase 2, Prymeview Gardens, and Godson Rehoboth, you position yourself ahead of the market and secure land that could propel your wealth in the years to come.