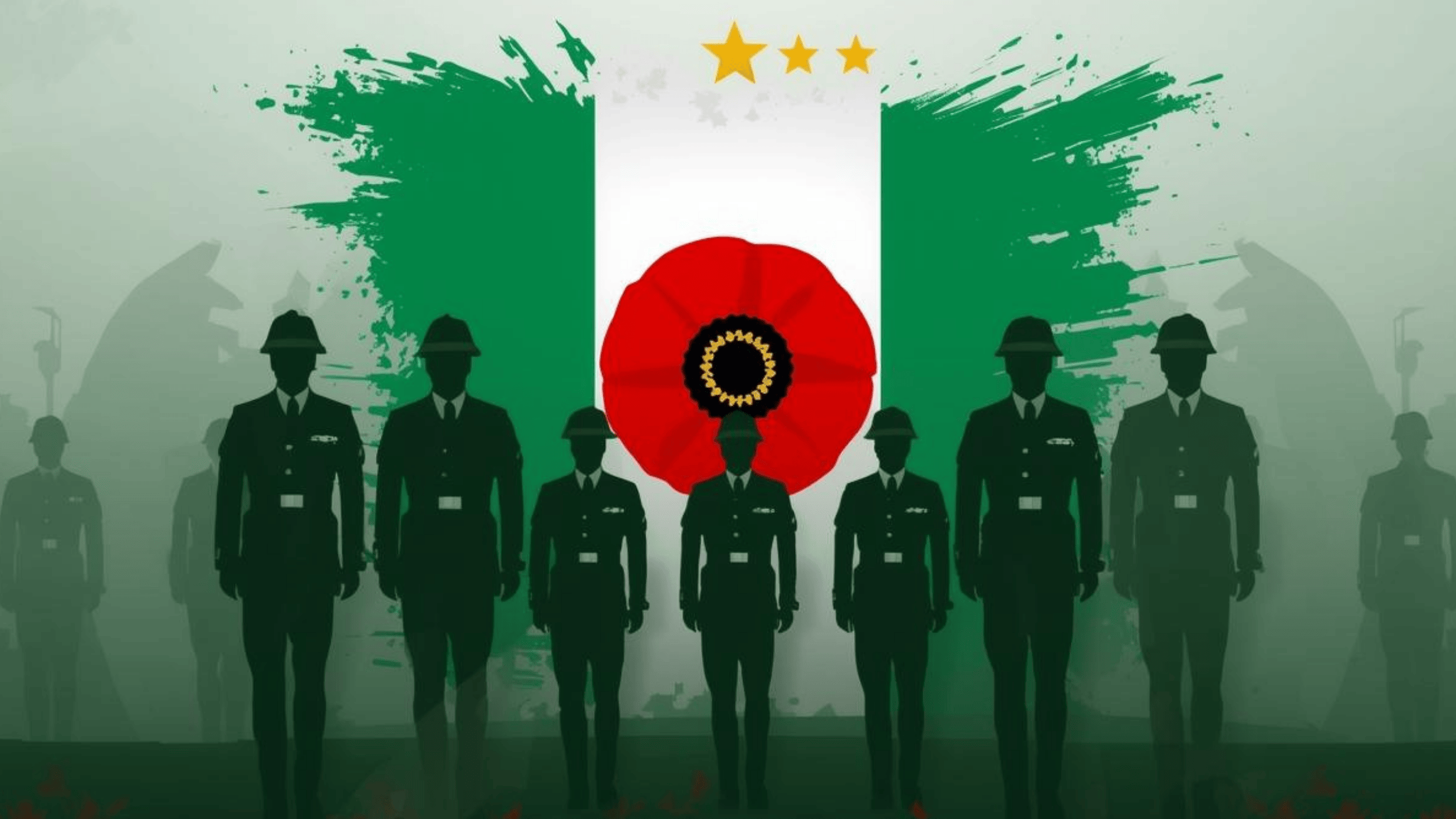

Armed Forces Remembrance Day: Property Investment Lessons on Discipline

January 15, 2026

admin

Every year, Armed Forces Remembrance Day invites Nigerians to pause and reflect on discipline, sacrifice, patience, and long-term commitment. While the occasion rightly honours fallen heroes, the principles behind military service quietly mirror what separates successful real estate investors from those who struggle, panic, or quit too early. In property investment, as in service, discipline is not dramatic. It is quiet, consistent, and often uncelebrated until results begin to show.

Over the years, working with first-time buyers and seasoned investors alike, I have noticed that the most profitable property decisions are rarely impulsive. They are shaped by habits that look boring on the surface but compound powerfully over time.

Discipline Over Emotion in Property Decisions

One of the first lessons from military training is emotional control. Decisions made in panic rarely end well. The same applies to real estate. Many Nigerians buy property out of fear, fear of prices rising, fear of missing out, or fear of being left behind by peers. That fear often leads to rushed purchases, weak documentation, or buying in the wrong location.

I once advised a buyer who wanted to purchase land simply because “everyone is buying there.” A disciplined review of the title history and development timeline revealed serious red flags. Walking away felt painful in the moment, but months later, multiple buyers in that area were locked in disputes. Discipline in property investment often looks like restraint, not action.

Military discipline teaches that not every battle is yours to fight. In real estate, not every opportunity deserves your money.

Strategic Planning Beats Short-Term Excitement

Another core military principle is planning before engagement. No mission succeeds without clear objectives, logistics, and exit strategies. Yet many property investors enter deals without defining why they are buying. Is it for rental income, capital appreciation, future development, or resale? Without clarity, even good properties can become bad investments.

I have seen clients buy beautifully finished homes with no understanding of rental demand in the area. The property looked impressive, but the numbers never worked. Discipline means aligning every purchase with a clear strategy and resisting distractions that do not serve that plan.

This is where structured advisory matters. At Pryme Point Real Estate, we guide clients to match property type, location, and documentation with their investment goal, whether that is steady rental income or long-term capital growth. Discipline is not about saying yes to everything; it is about staying loyal to your strategy even when alternatives look tempting.

Patience as a Wealth-Building Tool

Armed Forces service reminds us that results often come after long periods of preparation and waiting. Real estate rewards the same patience. Many Nigerians expect instant returns from property, forgetting that land and housing are long-term assets by nature.

A client once bought land on the outskirts of a growing corridor against popular opinion. For years, nothing seemed to happen. Then infrastructure arrived, access roads improved, and demand followed. What looked like a slow decision became one of his strongest assets. Impatient investors would have sold too early or never entered at all.

Discipline in property investment means understanding timelines. Appreciation, rental stability, and portfolio growth rarely follow overnight patterns. Those who respect the process tend to win quietly.

Order, Records, and Legal Structure Matter

The military runs on structure, documentation, and accountability. Property investment is no different. Poor record-keeping, incomplete documentation, and informal agreements create vulnerabilities that surface at the worst possible time, usually during resale or inheritance.

Many disputes in Nigerian real estate are not caused by bad intentions but by sloppy structure. Missing receipts, unsigned agreements, or unperfected titles can erase years of progress. Disciplined investors treat documentation as part of the asset itself, not paperwork to be rushed or postponed.

This is why end-to-end due diligence, proper documentation, and clear ownership records are non-negotiable. A property without structure is like a mission without command; confusion eventually takes over.

A Quiet Lesson Worth Remembering

Armed Forces Remembrance Day is not loud. It is reflective. That tone carries an important lesson for property investors. The strongest portfolios are built quietly, patiently, and with discipline. No shortcuts, no emotional decisions, no unnecessary battles.

As Nigeria’s real estate market continues to mature, discipline will increasingly separate sustainable investors from speculative buyers. The lesson is simple but powerful: treat property investment with the seriousness of a long-term mission. Plan carefully, act deliberately, and respect the process.

That mindset, more than hype or luck, is what builds lasting wealth.